Sole Proprietorship Car Tax Malaysia

The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. Apart from this the following requirements must be met in.

Personal Tax Relief 2021 L Co Accountants

Within All Malaysia Government Websites.

. Consequently some may consider closing their Sole-Proprietorship or Partnership. While some businesses were able to recover to their pre-pandemic state others still struggle due to the many pandemic risks and unforeseeable circumstances. Additionally setting up a sole proprietorship still allows an opportunity for the business to grow.

In Malaysia the economy started to recover in the fourth quarter of 2021. Full ownership- A sole proprietorship is owned 100 by a single person. Freelancer have to submit tax in Malaysia.

I am working for a company which is going to give me a company car worth RM150kI also have a sole proprietor business which make a good profitThe questionsShould I accept my salary job company car or use my sole prop business to buy a carIf I dont take my salary job company car I can request for car. Jun 25 2019 Blog. If you have not registered a sole proprietorship we advise you to do so immediately because it is an ideal business structure for freelancers.

Only the business owner can apply for a sole proprietorship. 17-2 Dinasti Sentral Jalan Kuchai Maju 18 Off Jalan Kuchai Lama 58200 Kuala Lumpur Wilayah Persekutuan Kuala Lumpur. SOLE PROPRIETORSHIP Personal Name.

In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the LHNDM Branch that is closest to you if the form does not reach on time Filling out Forms B Sole Proprietorship and P Partnership is required. A sole proprietorship is held entirely by a single person who uses their personal name identity card or trade name. A company is tax resident in Malaysia for a basis year if.

Foreigners and corporate legal entities are not permitted to register sole proprietorships in Malaysia. Lease rentals for passenger cars exceeding RM50000 or RM100000 per car the latter amount being applicable to. Petrol allowance insteadWhich way is.

The lower cost for setting up the company. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956. As such the owner receives all profits and makes all executive decisions for the business.

You then need to name your sole proprietorship either as your personal name or a business under which you trade. Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc. No corporate tax imposed- As the sole proprietorship is not a separate legal entity from the owner it will not get taxed as such.

But its better than having to pay more unnecessary tax being blocked from getting a carhome loan receiving fines. The lower amount of paperwork. This is because of the following laws set in place.

Should the owner ever decide to expand there is always the opportunity to change the business to either a partnership or a private. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. To do this you will need to register your new business at a local SSM branch.

ROBA 1956 and Registration of Businesses Rules 1957 is a type of sole proprietorship and partnership business. The overall simplicity of execution. Please select one of these options.

MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia. Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it. Basically this means you are the business and the business is you.

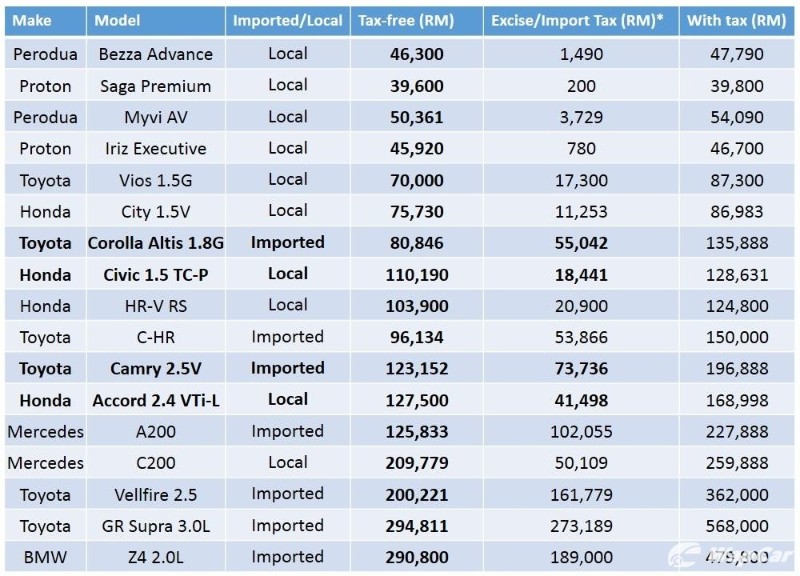

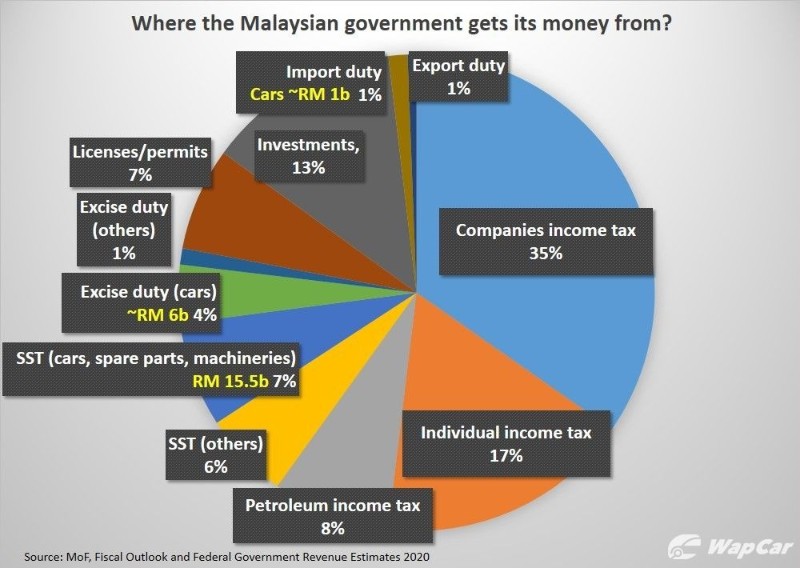

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

List Of Tax Deduction For Businesses Cheng Co Group

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment